Strategy Series - The Catalyst Driven Value Trade

There is no doubt momentum and memes can drive the crypto asset markets.

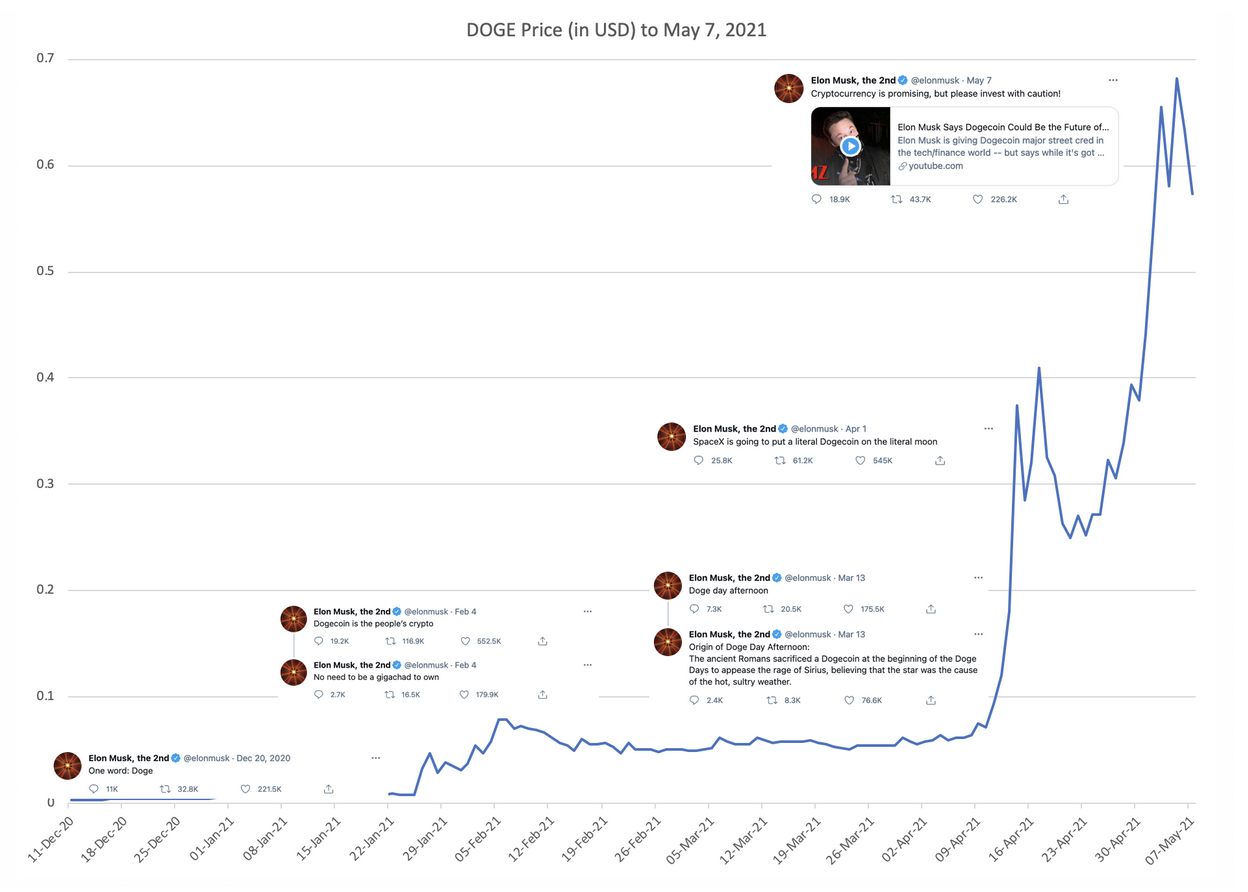

Being on the wrong side of one major move in a single crypto asset can negate all the hard work, meticulous research and market timing happening in the rest of the portfolio. Going short can be especially risky. Look no further than DOGE, which went parabolic from December 2020 to May 2021, and remains 100x its year end levels.

The market can remain irrational longer than you can remain solvent

(John Maynard Keynes)

One of our core tenets at Hartmann Capital when navigating the digital asset space is value investing, but risk management is the key to survival in volatile markets. This requires not only (1) a solid investment thesis but also (2) a full grasp of the technicals of the market as well as (3) a clear view of the catalyst that will cause the market to conform within a short enough time horizon to lower the risk of the market getting even more irrational.

Whale-size trades or simply WallStreetBets massive retail pumps (quickly pushed by professional momentum traders), combined with the relative illiquidity of many crypto assets means you are only a meme away from a short squeeze.

In this blog we provide four examples of one of our core strategies, the ‘Catalyst Driven Value Trade’, on both the short and long sides.

Two Value Shorts and Two Value Longs

On the short side, the challenge is to take advantage of our value call that some tokens are simply worthless while limiting our exposure to pumps. We are not big fans of XRP, yet the price action of earlier this year is indicative of how fast market sentiment can change, and how fast losses can accumulate on the short side. Both have questionable paths to becoming currencies, yet DOGE, at least, has some cultural value. Nevertheless, being short DOGE could have rapidly sent a trader to the poorhouse, having risen 211x since December.

How do we profit from our value assessments (of zero)?

Source: Coingecko.

Markets that rise fast often can crash quickly, but what final bad news (or lack of good news) finally breaks the bull run is near-impossible to predict. Standing in front of a retail buying freight train is therefore not generally recommended, even if the spoils that accompany a perfectly-timed market call can be great. Both DOGE and XRP have given back half of their 2021 gains.

The timing conundrum can be solved by identifying near-term catalysts. Just as Elon Musk tweets and rumors of a weak legal case can send DOGE or XRP up by many multiples, negative news or even lack of a follow up to rumors can send markets down by large percentages.

On the long side, our two cases below highlight the difficulty in fundamentally valuing any DeFi project.

TradFi metrics are often invoked in crypto value investing, but the question always becomes what growth rate to use for future cash flows, when comparing price-to-earnings (PE) ratios or performing discounted cash flow (DCF) analysis.

Subtlety is out and memes are in, even for such value investing. Therefore, we seek significant and obvious (to us!) value anchors that have yet to be recognized by the market, but where that recognition is imminent. The market can’t comprehend the difference between a 15x and 20x PE ratio, for example, because it’s impossible to compare future earnings with any accuracy. But certainly the market should be able to differentiate between zero earnings and the rapid accrual of economic value. Used in this latter way, value investing using TradFi metrics has its uses.

Again, prudent value investing requires both market irrationality and the existence of a future catalyst to force the price to our identified value. Nexus Mutual’s catalyst is a sad story for the founder Hugh Karp, who was hacked and had his tokens sold out from under him forcing token value to slip below book value for the first time. Our view was that, once the stolen coins were sold or selling ceased, the market would return to normalcy.

MakerDAO’s catalyst was actually the obscurity and apathy it had earned from the community, while silently becoming a money making machine. After a long period of being ignored and partially looked down upon as a failure after a system malfunction during the March 2020 Crash, Maker had been vastly overlooked. MakerDAO quietly raised stability fees for its ETH loans, with value accruing directly to the MKR token. In the early days of this fee growth, the price hardly budged. We saw that the catalyst being the market’s eventual realization that MakerDAO was a “cash cow”, with tens of millions of dollars accruing directly to the token, which was at the time unusual for a DeFi protocol.

XRP - Predicting delisting and liquidation post-SEC charges

Short: ~$0.48 December 22nd 2020

Cover: ~$0.25 December 23rd 2020

Ripple Labs has yet to provide the market with a convincing use case for its XRP token, and Hartmann Capital has identified several other key problem:

Token ownership is highly centralized, controlled by Ripple Labs

The token confers no governance rights

There is no mechanism for the token to accrue value

The team is a frequent and relentless seller of the token

Ripple Labs’ tech does not require the XRP token

While it’s true that many other projects in crypto do not have any valid value proposition, XRP had an obvious catalyst for lower levels, Ripple Labs and two executives were charged by the SEC on December 22, 2020 for selling over $ 1.3 billion in unregistered securities.

Source: Coingecko. Securities and Exchange Commission.

What Hartmann Capital believed the market was missing was that the SEC action would almost certainly cause US exchanges to delist XRP, and many funds to liquidate the position.

XRP does not follow the Ethereum token standard (ERC-20), and therefore holding Ripple’s token non-custodially is not easy. A lot of it was held on exchanges as a result. US holders were bound to panic as their main source of liquidity was slowly shut off. And panic they did.

Hartmann Capital sold XRP short on December 22nd at around 48 cents, before any delistings or liquidations had yet occurred.

The following 48 hours resulted in a frenzy of delistings and even expulsions from index funds. After the XRP token had shed half its market cap and short interest grew significantly, we began covering some of our short position, as the opportunity for further negative catalysts became slimmer and the risk of a short squeeze increased.

Source: Leo Hadjiloizou

In the end, XRP did rally hard on the back of the neutral news that the SEC’s case was perhaps not as solid as had been first feared.

While we still feel strongly that the true value of XRP is zero, we leave long term shorting to the gamblers, and focus on dealing catalyst-driven blows when the opportunity presents itself.

DOGE

Short: $0.66 May 8th 11:44pm 2021

Cover: $0.53 May 8th 11:55pm 2021

The bear case for DOGE has been stated an untold number of times: The technology is tired, token supply is theoretically unlimited, and control is held in very few hands. Yet it would have been pure insanity to stand in the way of the retail bull run (assisted by institutional momentum traders) that started in December 2020.

Elon Musk became the darling of the community after tweeting positively on many occasions. He first tweeted his support in April of 2019, when the token was at $ 0.00367.

Source: Twitter.

Since then, Elon has tweeted regularly and frequently.

Source: Twitter. Coingecko.

Buy the rumor, sell the news.

An 11-minute trade.

DOGE and Elon supporters awaited his chance to plug DOGE when hosting Saturday Night Live on May 8th. Speculation went wild amongst supporters as to what he could say. Some even suggested Musk would announce that Tesla would be adding Doge to its balance sheet. Of course speculation is all it was, and in the markets we have a saying: “Buy the rumor, sell the news”. The moment all the rumors would end, and the news was out, would be the moment Elon opens his mouth on the actual episode. As the camera first caught a glimpse of him, Hartmann Capital entered a short position and closed it mere 11 minutes later after the meme token had shed 20% of its market cap.

Source: Binance.

MakerDAO

Accumulated: ~ $535 December 2020

Sold: ~ $1,400 January 12th 2021

MakerDAO is the veteran lending protocol, established in 2017. Any true crypto maximalist favors the US-pegged DAI stablecoin over any of the (fully-centralized) alternatives, including USDT and USDC.

DAI is currently the fourth largest USD-pegged stablecoin, and the only one in the top four with any decentralization.

Source: Messari.io

Simply put, MakerDAO issues DAI in return for collateralized deposits, originally only ETH but now include many other tokens and even stablecoins. MakerDAO currently charges fees for these loans, and all fees after expenses and capital retained in the Treasury are used to buy back and burn the native MKR token, almost identical to how a TradFi stock buyback is effected.

After being heavily stressed during the March 2020 COVID ETH crash, MakerDAO cut fees to zero to attract deposits and stimulate DAI issuance. For most of 2020, therefore, MakerDAO was like almost every other decentralized finance investment: not income-generating for tokenholders.

All of that changed in late September 2020, when the stability fee for ETH collateral went from 0 to 2.25%. Few noticed and the MKR price hardly budged, after taking into account the general rally in crypto assets.

Source: Makerburn. Coingecko.

This situation could not last. The direct relationship between fees and MKR value makes MakerDAO one of the easiest crypto investments to value using traditional metrics, such as price/earnings ratio. The P/E ratio gradually decreased from near infinite as fees rose but the MKR price did not respond.

Hartmann Capital accumulated MKR at PE ratios in the low 20s/high teens, very attractive for any growth stock. By January 2021, MKR investors finally adjusted for the increasing fees. PEs got into the 50-60s, as MKR temporarily overshot the then-current running levels of fees.

Source: Makerburn.

While in hindsight MKR still had further to run based on increasing income, the catalyst had been realized: MKR was now tracking stability fee income, as it should have been all along. In fact, we are once again significant MKR holders as of late March as price again had a chance to re-set and earnings 5x’d since our entry.

Nexus Mutual: Bad luck panics a seller’s market

Accumulated: ~ $17 December 2020

Sold: ~ $55 January 19th 2021

Nexus Mutual provides insurance for hacks and exploits in DeFi protocols as well as for counterparty risks to centralized crypto custodians.

Nexus Mutual holds 162,425 ETH as capital backing its underwritten cover. As Nexus Mutual tokens are entitled to all protocol income after expenses, its token market capitalization should have a floor value equal to its Treasury holdings, less expected losses due to insured events. In fact, most insurers trade well above 100% of Net Asset Value (NAV).

Due to a decline in demand for smart contract cover, Nexus Mutual was significantly over-capitalized and selling its NXM token was impossible. As a result, a wrapped-version of the NXM token, named WNXM, was created in July 2020 that could be sold into the market.

On December 14, 2020, founder Hugh Karp’s Metamask was hacked and $8 million’s worth of NXM tokens were stolen. Those ended up wrapped as WNXM and eventually found their way into the market.

That selling pressure, and without any natural buyers (who were stuck in NXM), the price fell rapidly from 0.03x ETH to 0.02x ETH. WNXM traded just above NAV on December 29th and closed below NAV for the first time on January 11, 2021.

Few weeks after building our position, the market realized this price disjunction and drove the price of WNXM back to parity with NXM, at which Hartmann Capital (temporarily) closed its position until the next opportunity for a close to book value deal presented itself.

Source: Coingecko. Nexustracker.io.

Source: Binance.

Closing Thoughts

Value investing works best when there is an identifiable catalyst that appears certain to emerge in the near term.

While traditional modelling is difficult when growth rates are impossible to predict, there are occasions where prices can be said to be irrational, with high conviction. These two long side opportunities reveal that cash-flow can be king, even in markets driven by memes and momentum, as long as there’s an identifiable catalyst. The two short trades above show that short sales of seemingly valueless tokens may be less risky if a solid near-term reason for the market to turn bearish can be identified. Risk is mitigated by the short-term nature of such trading.

Value + Catalyst = Risk-Adjusted Alpha

Hartman Capital is agnostic on how we earn our alpha, but we always are on the lookout for the value floors that reduce our downside, and provide a foreseeable catalyst to monetize in the near future.

Disclaimers:

This is not an offering. This is not financial advice. Always do your own research.

Our discussion may include predictions, estimates or other information that might be considered forward-looking. While these forward-looking statements represent our current judgment on what the future holds, they are subject to risks and uncertainties that could cause actual results to differ materially. You are cautioned not to place undue reliance on these forward-looking statements, which reflect our opinions only as of the date of this presentation. Please keep in mind that we are not obligating ourselves to revise or publicly release the results of any revision to these forward-looking statements in light of new information or future events.